E-Mobility in Europe: Navigating a Shifting Competitive Landscape

The EV Dream: Is Europe’s Electrification Journey Losing Momentum?

When we think of electric vehicles, Tesla used to be the default image. Not anymore. The European EV market is no longer just a playground for local champions. Chinese automakers like BYD are now household names, undercutting European brands on price and pushing incumbents to accelerate innovation.

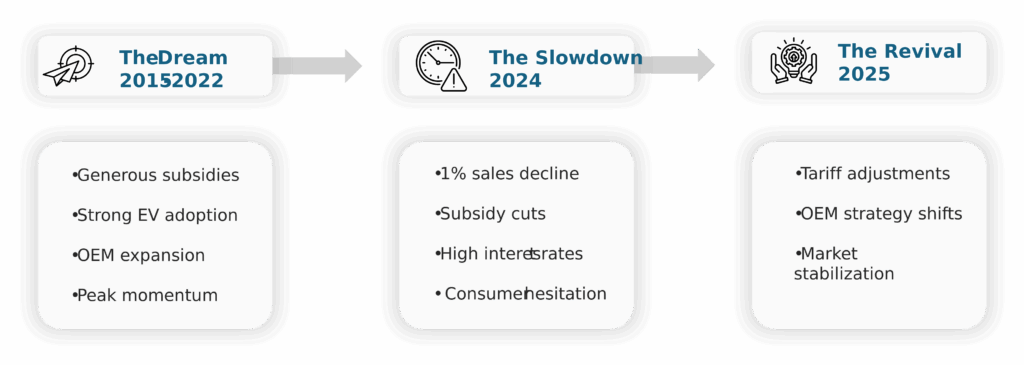

This new wave of competition comes at a complicated time. After years of double-digit growth fueled by generous subsidies, Europe’s EV adoption curve is starting to show signs of a slowdown. Incentives are being rolled back, production costs are climbing, and policymakers are facing tough budget trade-offs. The result is a market caught between momentum and headwinds. It is growing, but at a slower pace. The revival is underway, but it is happening under intense pressure from global rivals.

The Slowdown: Subsidy Slashes to Electrification Divide

Europe has been at the forefront of the global EV revolution. More than a decade ago, governments across the continent started to subsidize the purchase of electric cars, leading to a rapid increase in adoption. However, the pace of this transition has recently slowed down.

Several factors have contributed to the decline in EV sales in the region, from subsidy cuts to high vehicle prices and economic instability. Let us take a closer look at the key factors behind this slowdown.

Subsidy Slashes

One of the key drivers of the early EV boom in Europe was the generous government subsidies and incentives offered to consumers. However, in recent years, governments across Europe, especially in high-adoption markets such as Germany and France, have begun to scale back or even eliminate some of these incentives, citing budget constraints and shifting policy priorities.

Pricey EVs: Are They Too Expensive for the Mass Market?

While subsidies were still in place, the cost of EVs remained higher compared to conventional gasoline or diesel cars. The prices have adjusted slightly due to advancements in technology, but the cost of its components, such as batteries, and the overall production of electric vehicles, make them unaffordable for most of the population in Europe.

The Impact of Economic Turbulence

Buying a new vehicle is a major economic decision for consumers. Macroeconomic factors like inflation and rising interest rates compel buyers to prioritize their needs, and an expensive EV often does not rank at the top of the priority list. Additionally, the high interest rates set by the European Central Bank (ECB), primarily to tame inflation, have made auto loans significantly more expensive, putting EVs out of reach for many average buyers.

Electrification Divide: How Europe’s EV Growth Is Not Equal

The slowdown in the EV market was not experienced by the entire continent. There were countries that did really well in 2024, despite the ongoing slowdown in others. Countries like Portugal, the UK, Denmark, and the Netherlands had a success story to tell, while on the other hand, Germany, Sweden, Switzerland, Finland, and France experienced different headwinds in their EV market, leading to a slowdown in adoption.

Market Revival in 2025

The European EV market hints that the slowdown may be easing. Germany, France, and the UK, which collectively represent around 50% of the European EV market, are setting the tone for a gradual recovery.

- In Germany, falling EV prices and a strong leasing market are pulling buyers back in.

- In France, a generous eco-bonus scheme tied to locally produced models has pushed local manufacturers into a strong position.

- Meanwhile, the UK is showing resilience, with BEVs climbing back in share despite policy wobbling on 2030 deadlines.

The drivers that are keeping the recovery of these countries on track are as follows:

Corporate Fleets: The Growth Engine

Corporate fleets have been the decisive engine of growth in the EV industry because they are easily regulated and targeted, compared to individual consumers.

Affordability: The Role of Falling Battery Prices

The fall in the prices of batteries is fueling the tailwind for the next phase of growth of EV adoption in Europe.

The Power of Policy: Can Government Targets Sustain Growth?

Europe’s long-term regulations, such as the 2030 climate targets and the proposed 2034 ban on new Internal Combustion Engine (ICE) vehicle sales, keep the certainty high for the manufacturer/suppliers to keep the electrification journey alive.

The Chinese Factor: The New Competitive Threat to Europe’s EV Market

While the European electric vehicle market is set to revive gradually, the threat from foreign competitors remains.

The Chinese EV manufacturers, including BYD and Nio, entered the European market in and around 2021-2023. Since then, the underdog has become a very strong contender. These foreign players are putting the European manufacturers in a tough spot because of two factors:

- Aggressive price difference between Chinese and European EVs.

- Cutting-edge technology with smart features incorporated in Chinese EVs, for a fraction of the price as compared to European EVs.

Furthermore, by 2028, China plans to establish manufacturing facilities within the continent to cater to European consumers, starting with a facility in Hungary. Chinese manufacturers have a very clear strategy: to offer more car options for relatively less money to attract cost-sensitive buyers in Europe.

The Mood in the Market: How Europe’s EV Industry is Coping

The European Commission launched anti-subsidy investigations in 2023 and followed through in 2024 with tariffs ranging from 17% to nearly 38% on Chinese-built EVs, in addition to the existing 10% import duty. But the pricing of Chinese vehicles allows these OEMs to absorb much of the tariff impact while remaining competitive against European manufacturers.

For Europe’s automakers, the rise of Chinese EVs is both a threat and a wake-up call. There is an urgent need for the European OEMs to design and offer a coping mechanism to get back on track in the race.

So, what should European manufacturers do to remain competitive in this market, while holding their ground for stable EV adoption over the years?

Strategies For What Comes Next

The European market players should work on differentiation, and it should go beyond the price point. Here are the three suggested areas where the local OEMs can work on to stay ahead in the market.

- Reliability and Quality: The EU market really values reliable and compliant vehicles. Models that meet safety and emissions standards, deliver consistent performance, and build consumer confidence can be a good differentiator.

- Fostering Partnerships: By aligning with other ecosystem players, like utilities, leasing providers, and charging operators, and utilizing local presence, it can provide a long-term revenue stream.

- Untapped Regional Opportunities: There are still pockets of opportunities that are underserved in Europe. There has been considerable focus on Western Europe in terms of EV adoption and charging infrastructure. However, Southern and Eastern Europe remain somewhat underserved. Suppliers who make these regions their priority and their go-to-market strategy will have an early movement advantage over other players.

As Europe’s electric vehicle journey unfolds, it is essential to understand that the EV race is not only about who can sell the most cars, but who can build the strongest electrification ecosystem. With Chinese OEMs pushing prices lower and policymakers dialing back support, the region must double down on innovation or risk losing its edge.

About the authors

Hassan Zaheer

Managing Partner & Chief Operating Officer – PTR Inc

Hassan is the Managing Partner & COO at PTR Inc. based in Abu Dhabi, UAE. With more than a decade of experience in the energy transition space, Hassan advises various Fortune-500 and blue-chip clients in the electrical infrastructure sector to sustainably grow their businesses, both through custom consulting work, marketing support services and tailored research reports by PTR, helping their executive management and boards make data driven decisions. Hassan is also a Member of Advisory Board for CWIEME Berlin and MENA EV Show, part of the Executive Editorial Board of APC Media and an advisor to the educational non-profit Better Humans Academy. Hassan has a tech background with a Masters in Power Engineering from the Technical University of Munich (TUM) and a BS in Electrical Engineering from the Lahore University of Management Sciences (LUMS). Additionally, he is also an Alumni of Center for Digital Technology & Management (CDTM).

Muhammad Rafey Khan

Team Lead EVCI Service – PTR Inc.

Rafey Khan is a Senior Analyst and Team Lead for Electric Vehicle Charging Infrastructure service. His research focuses on e-mobility topics, specializing in electric vehicles and their charging infrastructure. He has worked with major EVCI systems and component manufacturers, utilities, and CPOs to conduct research and provide consulting to 30+ markets around the world. He holds comprehensive knowledge of the E-Mobility market in the USA particularly around EV and EVSE technologies, emerging market trends, and regional competitive landscape.

He is an electrical engineer from Lahore University of Management Sciences (LUMS) and holds an MBA from the Institute of Business Administration (IBA). Before joining PTR, Rafey gained valuable experience in Schneider Electric and K-Electric, which are digital automation companies and utility companies, respectively.

Najd Nassereddin

Client Relationship Manager

As a Client Relationship Manager at PTR, Najd is responsible for growing and strengthening PTR’s client network across Europe and the Middle East. With over 5 years of experience in market expansion and client engagement, Najd has a proven track record of establishing and fostering valuable connections. Prior to joining the Power Technology and Industrial Automation sector, Najd worked for 2.5 years in the logistics industry, successfully developing markets in Europe, the Middle East, and ISC regions. With her degree in accounting and finance alongside her strong networking skills, Najd is well-equipped to contribute to PTR’s success in maintaining a satisfied and strong client base.

More about PTR

With over a decade of experience in the Power Grid and New Energy sector, PTR Inc. has evolved from a core market research firm into a comprehensive Strategic Growth Partner, empowering clients’ transitions and growth in the renewable energy landscape and E-mobility, particularly within the electrical infrastructure manufacturing space.